When you think about an “American car,” what do you picture?

Perhaps it’s a massive, full-size SUV like a Chevrolet Tahoe or Suburban, a Ford Expedition, or a Lincoln Navigator. These hefty vehicles are popular as family haulers and are prized for their outward size and perceived sense of safety.

But as automakers like Ford (F) move on towards an electric future and look to compete head-on with Chinese automotive rivals like BYD, CEO Jim Farley emphasizes that American buyers are going to have to make a sacrifice and break an automotive addiction that may seem un-American for the sake of the automobile industry’s future.

At a recent appearance at the Aspen Ideas Festival, the Ford figurehead teased that the automaker is dead-set on releasing a profitable, $30,000 all-electric vehicle developed by a secretive California-based “skunkworks” team.

However, Farley indicated that the next generation of electric Ford vehicles will not be the oversized SUVs and trucks that the Blue Oval is known for, as the team is focused on more compact, affordable vehicles that can turn a profit for the brand.

Despite American’s desire for larger-than-life vehicles that boast more than 300-400 miles of range, Farley argues that those kind of expectations on such a vehicle will be unprofitable and prohibitively expensive for not only the company, but the consumer.

“You have to make a radical change as an [automaker] to get to a profitable EV. The first thing we have to do is really put all of our capital toward smaller, more affordable EVs. That’s the duty cycle that we’ve now found that really matches. These big, huge, enormous EVs, they’re never going to make money. The battery is $50,000… The batteries will never be affordable,” Farley stated. In a statement to EV blog Teslarati, a Ford representative indicated that the CEO was toying with the idea of an electric version of the brand’s Super Duty heavy-duty pickup trucks, and not the F-150 Lightning.

“Monster Vehicles”

Despite most of the automaker’s bottom line owing itself to the sale of pickup trucks and other gas-guzzling vehicles, the Ford CEO recognized that Americans need to adopt smaller vehicles if the company were to reach profitability and compete with China’s latest and greatest.

“We have to start to get back in love with smaller vehicles. It’s super important for our society and for EV adoption. We are just in love with these monster vehicles, and I love them too, but it’s a major issue with weight.

“If we cannot make money on EVs, we have competitors who have the largest market in the world, who already dominate globally, already setting up their supply chain around the world. And if we don’t make profitable EVs in the next five years, what is the future? We will just shrink into North America,” Farley said.

More Business of EVs:

Farley’s Advantage

Red Bull Racing Team Principal Christian Horner talks with Jim Farley, CEO of Ford on the grid during the F1 Grand Prix of Miami at Miami International Autodrome on May 07, 2023 in Miami, Florida.

Farley is confident that Ford will be able to make a profitable EV in the United States, crediting effective government policy discouraging low-cost Chinese EVs from touching American soil as substantially benefitting the Blue Oval.

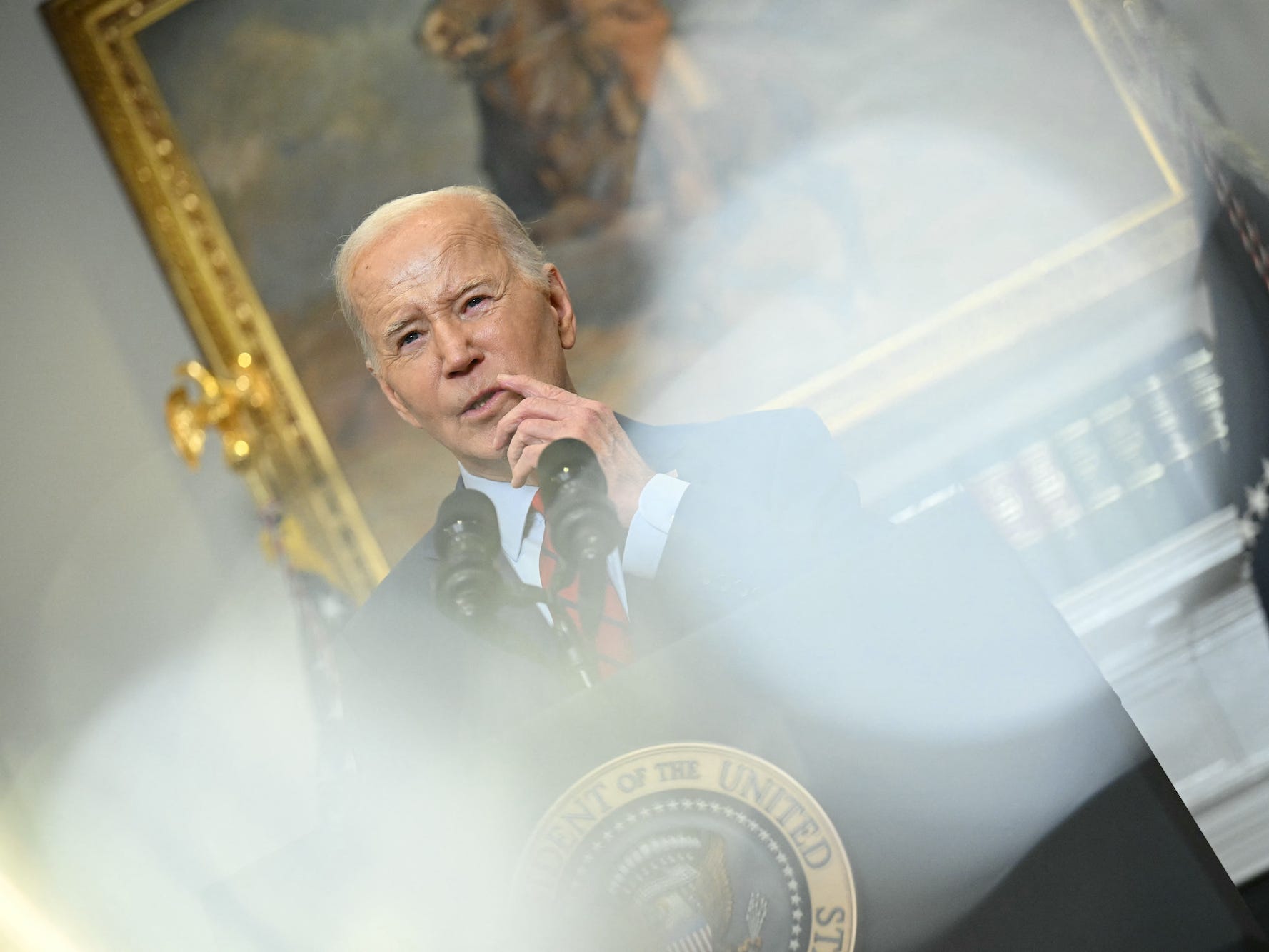

Currently, Ford is protected by an economic shield consisting of 27.5% tariffs that target Chinese-made vehicles before a single tire touches U.S. soil. Recently, President Biden unveiled a suite of tariffs intended to target China‘s “clean energy” initiatives, including a 100% tariff on EVs originating from the People’s Republic.

In a recent interview with Axios, Farley noted that government policies have helped “level the playing field with low-cost Chinese competitors” such as those made by auto giant BYD, adding that regulations also help address concerns about customer privacy and data handled by such firms.

“It seems like the government is very serious about passing policy around data privacy and autonomous technology coming from [Chinese automakers],” he told Axios. “With the recent changes, I am more confident than I was before that we would have a level playing field with the Chinese in the U.S.”