Five things you need to know before the market opens on Thursday January 5:

1. — Stock Futures Flat As Fed Minutes Challenge Rate Bets

U.S. equity futures were little-changed Thursday, while the dollar held steady against its global peers, as investors sifted through details of the Federal Reserve‘s inflation debate and focused on key jobs data expected over the coming days.

Minutes from the Fed’s December policy meeting, when officials agreed their seventh rate hike of the year, indicated concern that financial markets, as well as the public, would question the central bank’s resolve to fight inflation if it were to signal softer-near term rate hikes.

As it stands, the Fed is prepared to endure “below trend growth” in order to ease inflationary pressures, adding policymakers would need to see it “substantially more evidence of progress to be confident that inflation was on a sustained downward path.”

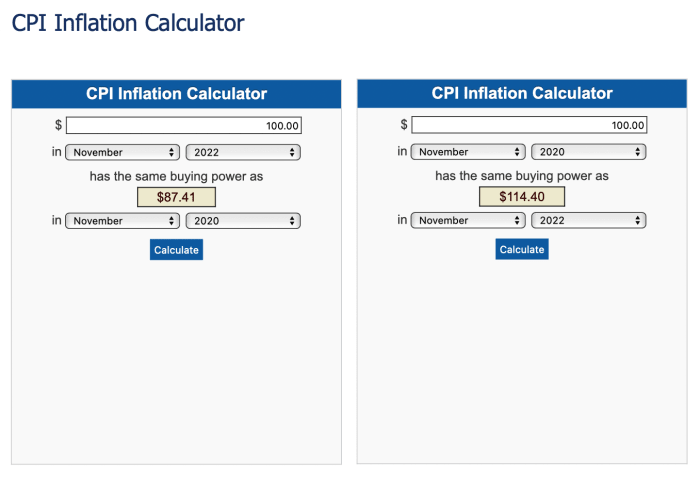

The hawkish commentary boosted bets on another 50 basis point rate hike next month, with the odds rising to 35.8% from around 27.2% last week, but had little impact on either the U.S. dollar or Treasury bond yields as markets continue to forecast slowing CPI pressures over the coming months.

Benchmark 10-year Treasury note yields were marked little-changed from last night’s levels at 3.716% while 2-year notes added 2 basis points to trade at 4.395%. The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 0.03% lower at 104.212.

The CBOE’s VIX volatility gauge was pegged at 22.16 points in the overnight session, after falling 3.23%, suggesting daily moves for the S&P 500 of around 53 points over the next 30 days, the highest since mid-December.

Overnight trading was mixed, with Asia’s MSCI ex-Japan index rising 0.78% into the close of trading following news that China’s border with Hong Kong would be opened after nearly three years lifted stocks on the mainline, while Europe’s Stoxx 600 slipped 0.02% following last night’s paring of gains on Wall Street.

On Wall Street, traders are likely to focus on the ADP jobs report at 8:15 am EST as well as official weekly jobless claims data at 8:30 am EST and the ISM services survey for December around 90 minutes later.

Heading into the start of the trading day, futures tied to the S&P 500 are priced for a modest 3 point opening bell gain while those linked to the Dow Jones Industrial Average are set for a 20 point bump. The tech-focused Nasdaq is looking at a 16 point advance.

2. — Jobs Data In Focus As Fed Highlights Wage Growth

The Federal Reserve emphasized the strength of the labor market as playing an important role in its inflation fight, according to minutes from its December policy meeting, putting the coming round of jobs data in sharp focus for traders on Wall Street.

The minutes indicated that Fed governors are seeing “tentative signs that labor market balances are improving”, but noted “large imbalances between labor supply and labor demand, as indicated by the still-large number of job openings and elevated nominal wage growth ”

JOLTs data for the month of November, published yesterday, indicated around 10.45 million open positions, a level that could feed in to wage growth over the coming months.

Investors will see data on private job creation today with payroll processing group ADP’s National Employment report at 8:15 am EST, followed by weekly jobless claims data shortly after.

Friday’s December non-farm payroll report is likely to show that employers added a net 200,000 new jobs to the economy last month, the slowest since May of 2021. Headline unemployment is expected to hold at 3.7%, while average hourly earnings are forecast to slow modestly to an annualized rate of 5.0%.

3. — Amazon Confirms 18,000 Layoffs As Big Tech Sheds More Jobs

Amazon (AMZN) – Get Free Report shares moved higher in pre-market trading after CEO Andy Jassy confirmed the tech and online retail giant is preparing a bigger-than-expected series of layoffs and job cuts.

The Wall Street Journal had said Amazon will cull as many as 17,000 from its global workforce, including upper management positions, over the coming weeks, a figure that is significantly higher than the 10,000 job reduction tally reported in November. Jassy said the tally would rise to around 18,000, with notifications to begin on January 18.

Amazon, the second-largest U.S. employer behind Walmart, with a global workforce of around 1.6 million, said its job cuts review had been “more difficult given the uncertain economy and that we’ve hired rapidly over the last several years”, a view echoed by Salesforce (CRM) – Get Free Report CEO Marc Benioff when he detailed headcount reductions at the enterprise software group yesterday.

Amazon shares were marked 2.44% higher in pre-market trading to indicate an opening bell price of $87.20 each.

4. — Johnson & Johnson Plans IPO For Consumer Health Care Division

Johnson & Johnson (JNJ) – Get Free Report shares edged lower in pre-market trading after the group unveiled plans to list its consumer healthcare division as a stand-alone company with around $15 billion in annual sales.

Johnson & Johnson, which first unveiled the spin-off plans in November of 2021, will list the consumer healthcare division, now known as Kenvue, on the New York Stock Exchange under the ticker symbol KVUE. The new group will include brands such as Band-Aid, Baby Powder and Tylenol.

The group’s pharmaceutical and medical devices division, which recently purchased heart pump specialists Abiomed ABMD for around $16.6 billion, recorded sales of around $80 billion in 2021, according to Securities and Exchange Commission filings.

Johnson & Johnson shares were marked 0.1% lower in pre-market trading to indicate an opening bell price of $180.00 each.

5. — Walgreens Earnings On Deck With Pharmacy Sales In Focus

Walgreen Boots Alliance (WBA) – Get Free Report shares slipped lower in pre-market trading ahead of the drugstore giant’s first quarter earnings prior to the opening bell.

Analysts expect Walgreen to post an adjusted bottom line of $1.13 per share for the three months ending in November, down 33% from the same period last, with revenues slipping around 3.6% to $32.77 billion.

The group may also detail the cost of its $5.7 billion settlement with several states attorneys general, agreed in early November, linked to its role in the nation’s opioid crisis. Walgreens booked a $683 million charge to its third quarter earnings, published in July, following an opioid settlement with the state of Florida.

CVS Health (CVS) – Get Free Report, Walgreens’ larger rival, lifted its full year profit forecast in early November after pharmacy sales topped Street forecasts.

Walgreens shares, a Dow component, were marked 0.11% lower in pre-market trading to indicate an opening bell price of $37.45 each.